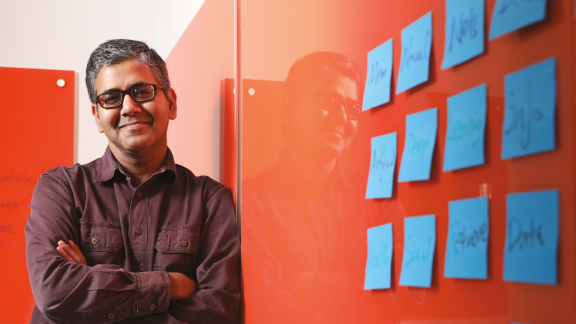

Alumni Profile

Facilitating Relief

“In a disaster recovery environment, you must be able to move quickly, improvise, and, most importantly, prioritize.”

Carlos Vázquez ’80 is the chief financial officer of Popular Inc., the holding company of Puerto Rico’s largest bank and the 40th largest financial institution in the U.S. He has a B.S. in civil engineering from Rensselaer and an MBA from Harvard. After 15 years at JP Morgan, Vázquez joined Popular as Executive Vice President in 1997 to establish and lead the Risk Management Group. He is credited with facilitating much-needed cash access for Popular’s customers during the devastating Hurricane Maria in 2017.

What were some of the challenges your customers faced during the days following Maria?

There were many challenges, but the most critical one and the one that was most underestimated was the lack of electricity. The local electric grid had been underinvested and undermaintained for decades, resulting in a very risky centralized generation and distribution system that did not survive hurricanes Irma and Maria. With no power, be it for personal or commercial activities, “life as we know it” stops working quickly. The lack of power also led to systemic failures in the communication network. This impeded the most basic of business transactions, like paying for goods with your debit card, even in commercial establishments that could open thanks to private emergency power generation. Access to cash became critical, so all our focus at the bank went to facilitating for our retail and commercial clients the quickest and most convenient access to their funds to help them deal with the emergency.

How has Banco Popular recovered?

Fortunately, we had a well-developed contingency plan, despite the limitations we discovered along the way. Our robust infrastructure allowed us to restore our operations and provide much-needed essential services to our clients very quickly. We also benefit from an incredibly dedicated group of employees that, despite considerable challenges in their personal lives, went out of their way to serve our clients and their communities. The bank entered this chapter in a very strong financial condition, ample liquidity, and the capacity to respond quickly and decisively. This strong base, plus the economic activity that resulted from the recovery effort, led to near-record financial performance for the company in 2018.

How can engineering help change people’s lives?

I think the most important skill that an engineer gets trained for is rather simple: the capacity to solve problems. The engineering specialization in which you trained or the nature of the problems needing solution are not as important. What we contribute is a unique problem-solving approach: the capacity to identify and synthesize data; the ability to conceptualize solutions; and finally, but no less important, complex project management skills to move those solutions to execution. These things are applicable to any and all problems, from health-care challenges to development, design, and finance.

What advice would you give to today’s students who want to make an impact on the world?

The challenges facing our professions, communities, and nations are as numerous and varied as our capacity to imagine potential solutions. As we learned in dealing with the hurricanes in Puerto Rico, you can’t plan for everything and most probably, you will end up doing many things that were not in your original plan. Be curious, embrace this uncertainty, and go solve problems, focusing on whichever ones instill the most passion for you. Finally, make sure you have good company for your journey, wherever it may take you. All this discovery is a lot more fun with good company.